Major Heading Subtopics

H1: Revolving vs Evergreen LC: Vital Discrepancies and When to employ Each and every for Extensive-Term Contracts -

H2: Introduction to Letters of Credit in Very long-Phrase Trade - Why LCs Are Employed in Prolonged Agreements

- The Purpose of Predictability in Source Contracts

H2: What's a Revolving Letter of Credit score? - Definition

- How It Works

- Kinds: Time-Primarily based vs Value-Primarily based

H2: Precisely what is an Evergreen Letter of Credit rating? - Definition

- Automated Renewal Element

- Validity and Expiry Conditions

H2: Revolving LC: Crucial Functions and Use Circumstances - Reusability Right after Utilization

- Greatest for Recurring Shipments

- Examples in Agriculture, FMCG, etcetera.

H2: Evergreen LC: Critical Characteristics and Use Circumstances - No Require for Handbook Renewal

- Suited to Steady Assures

- Examples in Lease Agreements, Source Chains

H2: Revolving vs Evergreen LC – Core Variations - Renewal Process

- Visibility of Expiry

- Banking Obligations

- Authorized Standing

H2: When to make use of a Revolving LC - Source Chains with Predictable Volumes

- Multi-Shipment Contracts

- Managing Finances Cycles

H2: When to utilize an Evergreen LC - Financial Ensures and Stability LCs

- Very long-Term Lease or General performance Contracts

H2: Pitfalls and Challenges Linked to Every - Revolving LC Threats: Miscommunication on Rollover Terms

- Evergreen LC Pitfalls: Ambiguity in Expiry Day

H2: Legal Tips and ICC Benchmarks - UCP 600 Guidelines

- Short article seven and ten for LCs

- Jurisdiction and Bank Liability

H2: Value Comparison Concerning Revolving and Evergreen LCs - Bank Expenses

- Doc Management

- Operational Issues

H2: Setting Up a Revolving LC: Stage-by-Phase - Arrangement with Consumer

- Lender Software

- Defining Time or Benefit Rollover

H2: Structuring an Evergreen LC Securely - Include Explicit Renewal Clauses

- Define Eventual Expiry Dates

- Use in Effectiveness Bonds

H2: Serious-Life Examples of Revolving and Evergreen LCs - Situation Examine of a Commodity Exporter

- Case Study of an Equipment Lease Service provider

H2: Revolving vs Evergreen LC: Comparison Desk - Element-by-Aspect Breakdown: Renewals, Expiry, Use Conditions, Threats

H2: Routinely Requested Queries (FAQs) check here - Can a Revolving LC also be Evergreen?

- Is a Financial institution Liable After Evergreen LC Expiry?

- Can Possibly LC Be Cancelled Early?

- Which LC Kind Needs Much less Admin?

- Are These LCs Employed in Domestic Trade?

- What Transpires if the client Defaults?

H2: Summary - Picking out the Proper LC According to Deal Demands

- Last Views for Exporters and Importers

Now, I’ll get started creating the extensive-kind post applying this outline.

Revolving vs Evergreen LC: Vital Variances and When to employ Every for Extensive-Phrase Contracts

Introduction to Letters of Credit history in Prolonged-Time period Trade

Extended-time period trade contracts, Specifically Those people involving recurring transactions or steady obligations, demand reliable and adaptable financial instruments. Two these tools typically Employed in these eventualities are classified as the Revolving Letter of Credit history and also the Evergreen Letter of Credit score.

These specialized sorts of LCs are designed to decrease administrative stress, be certain continuous security, and simplify recurring transactions between consumers and sellers after some time. But they’re not interchangeable—Each individual serves a distinct function in world wide trade and finance.

Exactly what is a Revolving Letter of Credit?

A Revolving LC is really a reusable credit facility that automatically restores its benefit just after use. It’s ordinarily issued for agreements involving various shipments or deliveries about a period of time, which makes it ideal for contracts dependant on common provide.

There are two Principal forms:

Time-Based Revolving LC: The credit history replenishes immediately after a set interval (e.g., regular or quarterly).

Worth-Based mostly Revolving LC: The credit score renews once a certain value has long been utilized.

Case in point: An exporter of grains incorporates a deal to ship $50,000 truly worth of corn regular monthly. As opposed to issuing a different LC on a monthly basis, only one Revolving LC for $50,000 is made and established to renew just about every thirty days.

Precisely what is an Evergreen Letter of Credit?

An Evergreen LC is an extended-expression LC with automatic renewal clauses. It remains valid until eventually a celebration gives observe of cancellation, ordinarily inside a predefined timeframe (e.g., 30 days ahead of once-a-year renewal).

It’s most frequently utilized for economical assures, like overall performance bonds, lease payments, or stability deposits.

Case in point: A company leasing machinery for five years may very well be necessary to give an Evergreen LC that renews yearly Except cancelled. This makes sure ongoing economical protection without the need of reissuing documentation annually.

Revolving LC: Key Features and Use Cases

Self-renewing credit history for recurring shipments

Cuts down Price tag and time of issuing various LCs

Normally Utilized in industries with large transaction frequency like:

Agriculture

Quick-Moving Purchaser Merchandise (FMCG)

Textile exports

Evergreen LC: Essential Capabilities and Use Circumstances

Instantly prolonged Until a cancellation recognize is served

Perfect for prolonged-term assures and compliance obligations

Employed in:

Lease Agreements

Utility or Devices Bonds

Effectiveness or Upkeep Contracts

Emilio Estevez Then & Now!

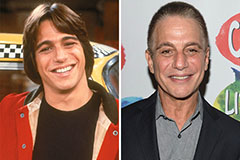

Emilio Estevez Then & Now! Tony Danza Then & Now!

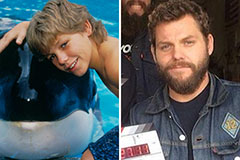

Tony Danza Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!